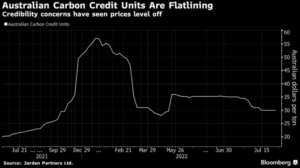

The Rise in the Australian Carbon Credit Units Price

Carbon Credit Units Price

Australia’s carbon credit units price has risen by a substantial amount in the past 12 months, driven by demand from Australian companies as they seek to meet their greenhouse gas reduction targets. The market is also maturing in the face of increased scrutiny, and trading volume has grown significantly.

In the first quarter, a record 5.5 million Australian carbon.credit were traded, according to the Clean Energy Regulator. This was a 400% rise from the same period last year. The increase in activity is a sign that the markets are maturing, and demand for credits is expected to increase further over the next couple of years. A number of new projects have been approved under the Emissions Reduction Fund, which is funded by a carbon tax. These include the Moomba plant near Adelaide, which Santos (ASX:STO) and Beach Energy are building.

The government has committed a total of AU$2 billion to the ERF. Some of this will be paid for by the Federal Government under contracts it has entered into with parties to create and sell ACCUs, while some will be applied to finance projects that generate emissions abatement. But despite this, there is no centralised market exchange for ACCUs and most are sold privately. Consequently, they remain undervalued when compared to global markets. However, there are a number of reasons for this discount, including:

The Rise in the Australian Carbon Credit Units Price

Australia has a national compliance emissions scheme called the ‘Safeguard Mechanism’ that regulates around 215 of the largest industrial facilities in the country, which are responsible for 28% of the nation’s emissions. These facilities are required to purchase and surrender to the government Australian Carbon Credit Units (ACCUs) or Stream Management Certificates (SMCs) based on their excess emissions.

By 2030, the safeguard mechanism will require all of its facilities to reduce their emissions or buy carbon offsets, which is likely to add further demand for ACCUs. This will support the ACCUs price, but will not be sufficient to make a material contribution to meeting Australia’s climate targets.

The price cap announced in July will help Australia’s large and energy-intensive industries (EITEs) in their investment planning. EITEs will be able to offset their emissions by up to $75 per tonne of CO2 equivalent, if they are not able to cut their emissions through other means.

This is in addition to the current price cap of $51 per tonne for all facilities, which has been in place since 2021 and is set to continue until June 2020. As a result, the price cap has helped to re-ignite demand for ACCUs and could help drive the Australian carbon offset market into maturity in a few years.

But a growing number of Australian corporates are still under-appreciating the benefits that ACCUs and carbon offset markets can offer. Currently, ACCUs are valued at just over $20/mtCO2e.

While this price is not competitive with global markets, it still represents a significant discount to the average global spot prices of $40/mtCO2e, which is still a very healthy price point for Australia. It is also a testament to the quality of Australian carbon offset projects, which are delivering real cuts in greenhouse gases.